Know the players, know the game

The players of the Forex market can be divided into the big guns and the individuals. To make it easy for you given below is a breakdown of all the different kinds of banks and companies involved.

1. Interbank Trade

This kind of trade takes place between the biggest banks in the world. The initial value of a currency is usually decided by these as they are form a big chunk of all the market movement that takes place. So their ask/bid rates become the standard. The others will usually adjust accordingly. What helps them is the insider information they have about the finances of their clients. Furthermore, they also help each other out by following debtor-creditor deals among themselves.

2. Central Banks and Commercial Players

These are companies or central banks that participate in the Forex market only to get better deals for their business. That is, they genuinely need the currency for their business or running and so they will try and trade their money at a good price.

3. Big Brokering Services

These services deal at a much grander level than the average retail broker. With these companies you get all kinds of deals depending on your reputation or credit situation. Same is the case with the banks.

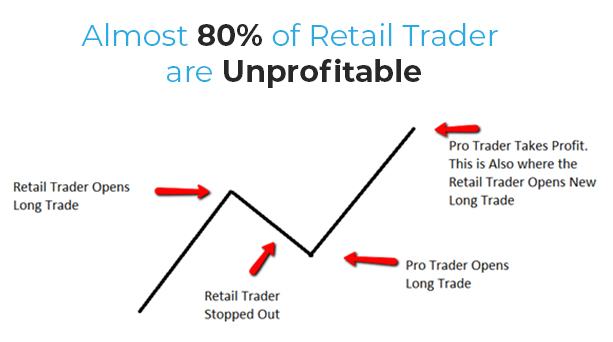

4. Retail Traders/Brokers

This is where the speculators and spot traders come in; people who are trying to make profits for their own individual selves with usually no bigger picture involved.

The fact that the Forex market is a decentralized one does not mean that there is no system. This decentralization actually means that there is no one party that is in charge of rates and quotes. It is a free market which opens up itself to all kinds of competition thus providing more opportunities to the trader as the brokers/dealers too are looking for clients and profits. This competition keeps the prices in check.

With this, you have passed Level 1 of your training. If you feel like you have a good grasp on these topics now, you may proceed to Level 2.