Technical Analysis

Summed up in one sentence - Study the past behavior to forecast future movement.

Fundamental Analysis

Economic, social & technological factors that affect the demand & supply of the market

The Psychology of Trading

Plan to accept calculated risk and feel comfortable about every trading decision.

Economic,Events,News

Its first Friday of Month, Announcement of US Non-Farm Payroll or any other world news. Not a single event can be ignored.

What Moves the FOREX Market?

- Quantity of currency traded through capital investments

- Foreign entities sell local currency and buy foreign currency to make direct investments

- Hedge Fund in Japan invest in US Equity Market

- Trade Flows: Exports minus Imports

- Balance of Payment = Capital plus trade flows

- Purchasing Power Parity

- Interest Rate Theory

CHOOSE OUR PLAN

TRADE PLANING FACTORY

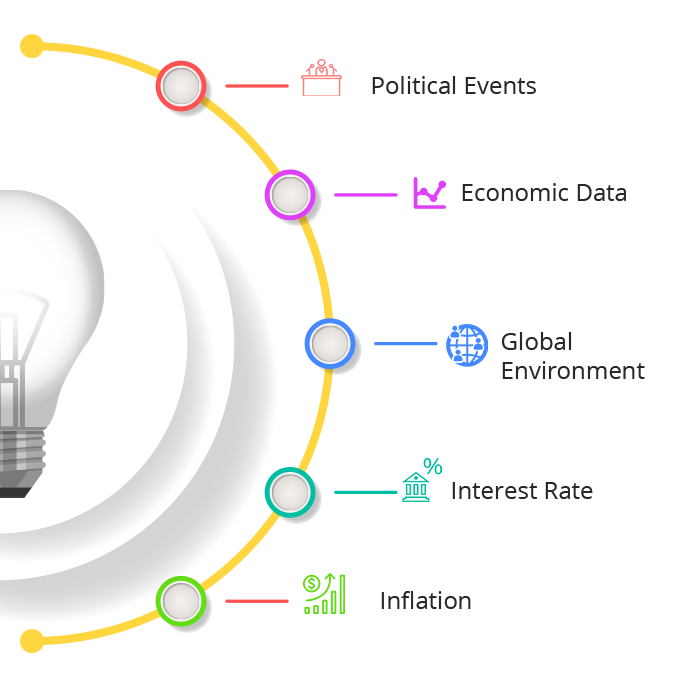

Analysis of Fundamental Factors that influence

Here are few of important factors need to be evaluated before planning any trade:

figure deviation, previous figure, expected figure, actual figure, if previous & expected differ … chance for fluctuation, carry trades, taking advantage of interest rate, differentials & buying high-yield/ selling low-yield, currency for interest, equity market correlation, buy currency – higher stock market earnings and as demand will improve – value will increase

Fundamentals by Country

European Monetary Union – EUR, European Interest Rate, GDP from Germany & Eur ozone, Harmonized CPI from Europe, Unemployment Data from Germany & Europe, Trade Balance from Europe, Industrial Production (Germany & Europe), ZEW Survey (Germany), 10 Year German Bond

United States – US$: Non-Farm Payroll, Interest Rate Decision, Trade Balance from US, US CPI, Consumer Confidence Index from US, US Retail Sales, GDP US, ISM Manufacturing Index US, Minutes of FOMC (FED)

JAPAN - JPY: Japanese Interest Rate Announcement, GDP – Japan, Tankan Survey, Trade Balance (and Merchandise Trade Balance), Japan’s Employment Situation, National CPI from Japan, BoJ Policy Minutes

United Kingdom - GBP: UK’s Interest Rate Announcement, GDP, UK’s Trade Balance, CPI (UK), Minutes of BOE Meeting

Canada - CAD: Interest Rate Decision, Canada’s International Merchandise Trade, GDP, Ivey Purchasing Manager Index (PMI), Consumer Price Index (CPI) Canada, Change in Canada’s Employment

Australia - AUD: Interest Rate Decision, Australian GDP, Employment Change for Australia, Consumer Price Index (CPI) of Australia, Trade Balance of Australia

Switzerland - CHF: Interest Rate Announcement, GDP, Trade Balance, Monetary Policy Assessment

Technical Analysis: Accurate Signals

See, Accept, Trade. Technical analysis plays a dynamic role for right trade plan. We examine various trading techniques. Following are few examples:

Types of Charts, Support and Resistance, Trends and Range Bound Conditions, Candlesticks

Types of Charts: LINE Chart, BAR Chart, CANDLESTICK Chart

Based on DOW Theory (3 main principles)

Price discounts everything (All information is reflected in the price),Price Behavior is not Random (Follow trends), “What” (or where) questions are more important that why: Where is the price and what is the historical behavior

Support and Resistance – Sustained Breaks:

A sustained break happens when the prices are traded above the resistance or below the support zone for several periods. Should this happen, the old resistance now becomes an important support (in the case of a break “up”) or the old support becomes an important resistance

Trends and Range Bound Conditions:

Trend, Range Bound and Ranging Markets, Trend Lines

Candlesticks:

Long Candlesticks, Short Candlesticks, Marubozu, Doji Candlesticks, Spinning Tops/ Bottoms, Long-legged doji, Dragonfly doji, Gravestone doji

Trading Psychology and Methodology

1- Perform a world class analysis to determine which currency pairs have the greatest profit potential.

2- Trade management techniques to take the most of each trade when the market moves on their favor.

3- Entry system adapts to the current market conditions, follow the market instead of guessing.

4- Risk management techniques to set stop loss and take profit orders at optimal levels.

5- Money management techniques to allow the geometric growth of their account and avoid the risk of ruin.

6- Accept risk and feel comfortable with their trading, they know it’s the only way to get consistent results.

Long-term analysis: Methodology to determine which currency pairs have the greatest profit potential.

Short-term analysis: Entry systems: breakout, retracement and continuation price action entries.

Capital management: Determine the formula that you will use to decide how much capital to risk on each trade.

Trade management: Strategies to manage trades, when to scale in and scale out of trade and more.

Risk management: Optimal levels to set stop loss, take profit levels, trailing stop to help you reduce risk.

Trading psychology: what needs to know to accept risk and feel comfortable about every trading decision made.

Sign Up

Signup for an account in just 1 minutes.

PayPal or major credit card.

Receive Signal

Daily alerts to your phone, email or website account. Buy, sell and stop-loss points that are easy to follow

Take Profit

See how your investments grows