What is Forex?

Forex or FX stands for Foreign Exchange. It is the market of currency exchange.

It is understandable that someone who is new to this might find it confusing because what do you buy money with? How does anyone make a profit in this transaction? Both of these are valid questions and will be answered during these lessons.

Forex Trading in a Nutshell

In Forex, a trader buys one currency using another. So in any transaction, one currency is being bought and the other being sold. Profits and losses come from fluctuation in rates of currencies.

Fluctuations in Currency Value

The value of one currency against another is dependent on country’s economy. It is, therefore, a very volatile market as a number of factors are involved and they are forever fluctuating. Nonetheless, it is the biggest in the world. To get a sense of exactly how big, keep reading.

FX has a daily turnover of $5.1 Trillion. This is more than any other trade/business in the world and one of the reasons behind this the round the clock trading.

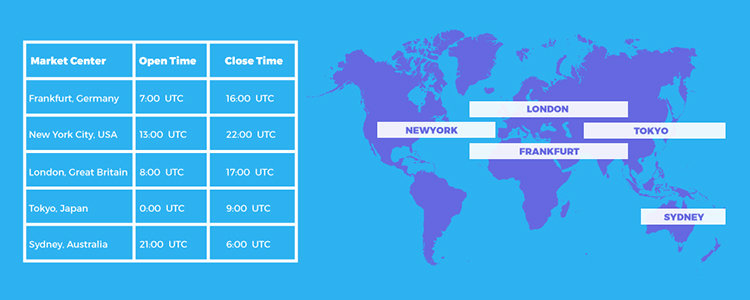

The Foreign Exchange Market stays open 24 hours a day, 5 days a week. It shifts from one financial center in the world to the other. Starting from Sydney it moves to Tokyo, then to London, then Frankfurt, and lastly New York. By the time the work day ends in New York, it is morning again in Sydney and so the cycle starts again.

To read more on this subject, you can check out our lesson on Forex Market Timings.

How currencies are traded

Currencies are traded in pairs. For example, GBP/USD means that you’re making a transaction between the British Pound and US dollar. In a pair the first currency is the base or transaction currency and the second is the quote or counter currency.

The base currency is the one that is bought or sold against the counter currency. This transaction depends on the information regarding currency prices that a trader can access online and through chart analysis. If it appears that the GBP will increase in value compared to USD, a trader will buy GBP.

If the prediction proves true and the value of USD begins rising, they will hold this position until they have made reasonable profit, or when they feel the value might drop. They will then close the deal by selling the USD they bought thus making profit on the difference between the buying and selling rate.

The success or failure of a trade depends on how accurately a trader is able to predict the direction the market will take.

Winning trade

If it’s an accurate prediction about the GBP rising, a trader will hold this position until they have made reasonable profit or if they notice the trend changing. They will then close the trade by selling the GBP they bought thus making profit on the difference between the buying and selling rate.

Losing trade

If things go wrong and the prediction is incorrect, it will result in a loss as the US dollar will have to be sold at a lesser price than the one it was bought at.

In Summary

Forex transactions always take place in pairs. So you’re buying and selling at the same time. When you buy GBP, you are doing it with the USD you have. So you pay USD to buy GBP. Similarly when you sell GBP you buy USD.

How many currencies participate and which ones are the most important? Read all about it in the next lesson!